Digital innovation[foot]Digital innovation describes a generative process, as well as its end result: any new (for the company) or significantly improved product, service, or process that relies in large part on digital technologies such as social, mobile, cloud computing, analytics, and/or the Internet of Things (IoT).[/foot] is a top business priority for companies seeking to better understand and competitively address the changing needs of customers and employees. Most companies are spending more money than they have previously on a “portfolio” of innovation efforts—but these efforts are often uncoordinated. Few companies have a coherent view of their innovation portfolio; even fewer understand the portfolio’s impact.

MIT CISR surveyed 201 companies, one respondent per company, across a wide range of industries on their innovation investments and practices.[foot]MIT CISR Survey on Digital Innovation, September–November 2016 (N=201); respondents were CIOs or their equivalents from companies based globally, though predominantly in the United States and Europe.[/foot] Respondents reported their business performance relative to competitors. Additionally, we drew on qualitative data from more than thirty companies regarding how their innovation practices have changed.[foot]Qualitative data, collected by MIT CISR research scientists from 2015 to 2017, were sourced from the center’s Designing Digital Organizations, Supply Orchestration, and Expanding Digital Innovation projects.[/foot] From these combined results we were able to identify what investments and practices distinguish the most and least competitive companies across a range of performance outcomes.[foot]The research findings in this briefing are the result of a team effort. I am grateful to Dr. Alejandro Neut of BBVA Research for his collaboration and his contributions to the statistical analysis; as well as to my MIT CISR colleagues for their help in framing and communicating the results.[/foot]

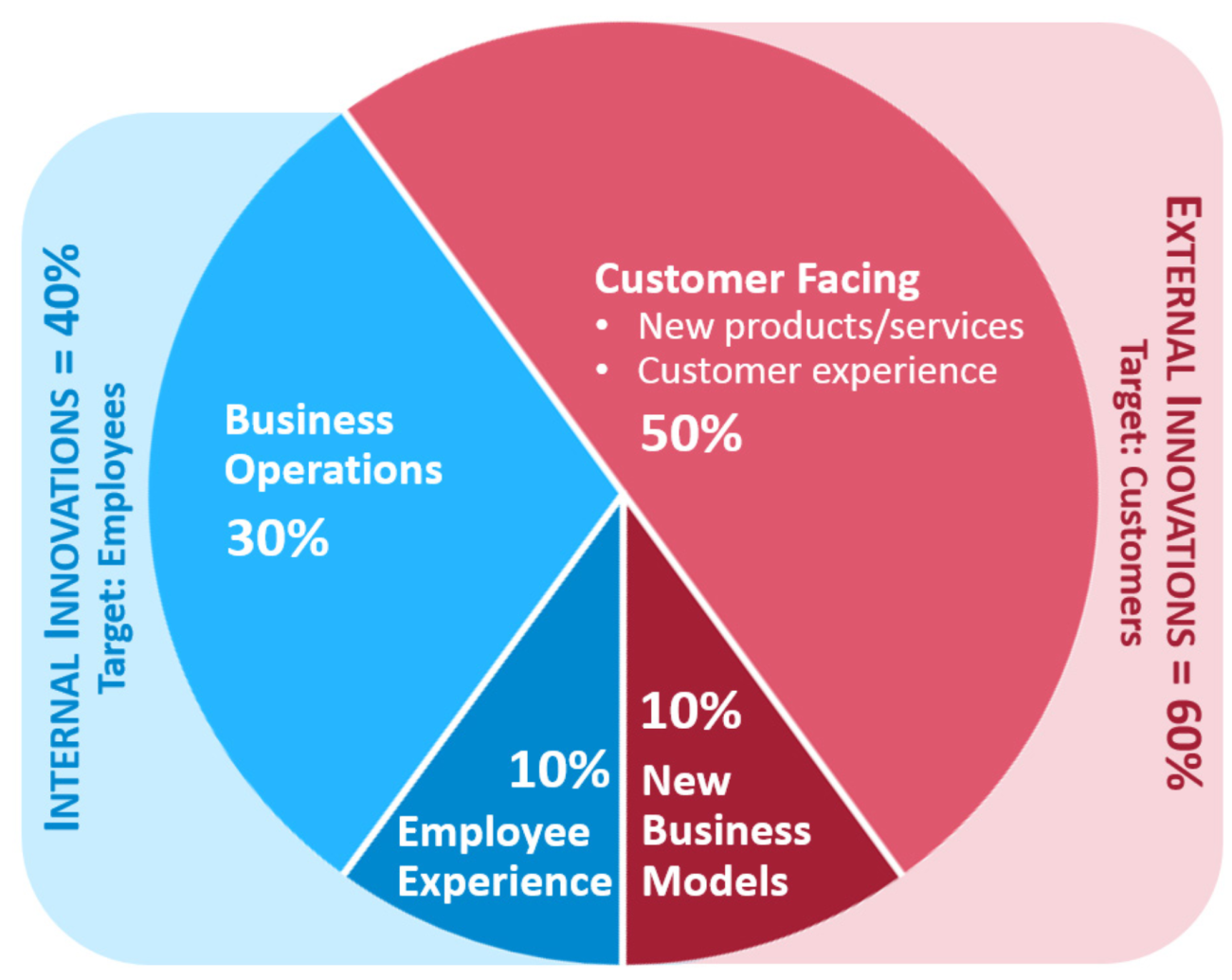

PORTFOLIO ALLOCATION, RATHER THAN TOTAL SPEND, IS WHAT MATTERS

Among our respondents, total spend on digital was not a competitive differentiator. The average amount spent on digital innovation varied by industry and company size; but comparatively, controlling for these demographics and along multiple performance outcomes, the most competitive companies did not spend significantly more on digital innovation than the least competitive companies.