Increasingly, companies aim to create more value for their customers by adding data analytics—in the form of recommendations, alerts, automated actions, dashboards, scorecards, advice, and trends—to products and experiences. In a 2018 MIT CISR survey of 511 product managers, eighty-five percent reported they were developing data analytics-based features or had deployed features to the marketplace.[foot]Between March and September 2018, the MIT CISR survey Creating Competitive Products with Analytics (N=511) surveyed product managers responsible for generating revenues from products. See MIT CISR’s report on the survey from R. Schüritz, K. Farrell, and B. H. Wixom, “Creating Competitive Products with Analytics—Summary of Survey Findings,” MIT Sloan CISR Working Paper No. 438, June 2019, https://cisr-mit-edu.ezproxy.canberra.edu.au/publication/MIT_CISRwp438_DataWrappingParticipantReport_SchuritzFarrellWixom.[/foot] Such data monetization efforts can generate lucrative returns for companies by increasing product sales, customer wallet share, and/or loyalty. Of course, if a customer doesn’t act upon a recommendation or alert, the potential value of that feature or experience never materializes. The contemporary challenge for digital leaders: how do you make certain that your customers use data analytics-based features or experiences in ways that make or save money or meet some other compelling need?

Don’t Leave Value to Chance: Build Partnerships with Customers

Abstract

This briefing describes three managerial levers—credibility and trust, digital customer connections, and interactive co-creation of solutions—that help companies shift transactional customer relationships to collaborative partnerships. MIT CISR research indicates that companies leverage collaborative partnerships to ensure that customers use data analytics-based features or experiences, which helps shift potential value from data analytics features and experiences to real value. The three levers are illustrated using a case of PepsiCo and its suite of data analytics capabilities, PEPWORX. Since early 2015, PepsiCo has invested in data and advanced analytics capabilities and used them to better serve the company’s retail customers, ultimately helping the company build collaborative partnerships.

This briefing describes three managerial levers that help companies shift transactional customer relationships into collaborative customer partnerships. Our research indicates that companies with collaborative partnerships have greater influence over customer use of data analytics features and experiences—and thus, over real value creation.

Creating Real Value from Information

Academics have long argued that the value of an offering is determined not by the offering’s features but by the value customers perceive and act upon. Providers can create potential value for customers, but only customers have full control over creating real value.[foot]In academia, this is defined as “service-dominant logic.” See R. Schuritz, K. Farrell, B. H. Wixom, and G. Satzger. “Value Co-Creation in Data-Driven Services: Towards a Deeper Understanding of the Joint Sphere,” International Conference for Information Systems, Munich, Germany, December 2019, https://aisel.aisnet.org/cgi/viewcontent.cgi?article=1527&context=icis2019.[/foot] This view assumes a transactional relationship in which a provider “passes off” an offering to a customer, who then acts—or not. Imagine, for example, a healthcare provider mailing healthy dietary guidelines to its patients, or a bank suggesting a few strategies for saving to customers opening a new savings account; in each case, the customer response is largely left to chance.

With today’s digital advancements, providers have the opportunity to engage in real value creation by connecting with, sensing, and responding to customers in novel ways. For example, consider the same healthcare provider integrating its standard recommendations for a healthy diet with the patient’s actual food consumption (submitted via an app), vital metrics (synced with wearables), and health risk indicators (calculated based on health records). In this case, the provider could automatically send tailored, contextual messages to the patient (via an app, portal, or device) that encourage specific changes to habits and daily routines and result in the patient eating more healthfully, thus creating real value.

Companies expanding their joint sphere with customers to jointly create real value from offerings produce better data analytics features and experiences, which results in greater financial returns.

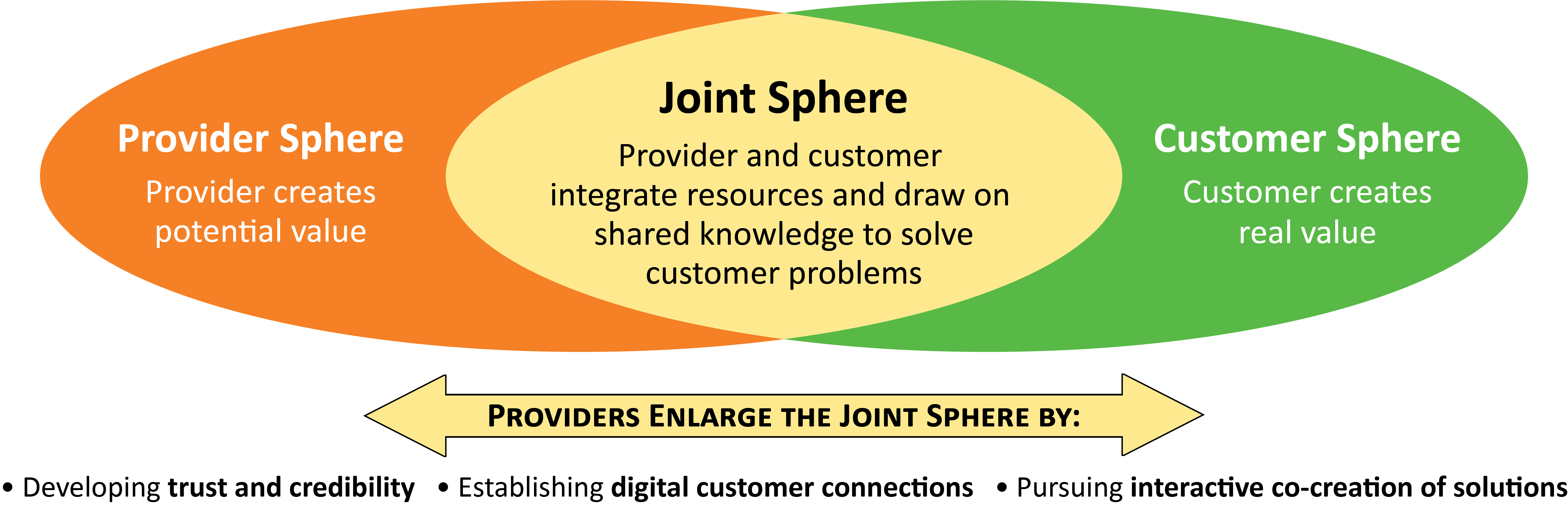

Academics conceptualize this new opportunity as a joint sphere[foot]R. Schuritz, K. Farrell, B. H. Wixom, and G. Satzger, “Value Co-Creation in Data-Driven Services: Towards a Deeper Understanding of the Joint Sphere.”[/foot] (see figure 1). In a joint sphere, a provider and customer jointly create real value by integrating resources and drawing on shared knowledge in order to solve customer problems. The joint sphere represents the relationship between a provider and a customer, and its size depends on how the relationship functions. For example, transactional relationships have smaller joint spheres in which providers merely set up and pass off solutions to customers; in contrast, collaborative partnerships have larger joint spheres that reflect a variety of ongoing provider-customer activities.

MIT CISR research has identified three managerial levers that help providers expand their joint sphere: credibility and trust, digital customer connections, and interactive co-creation of solutions.

- Providers develop credibility and trust by demonstrating their expertise and the ability to solve customer problems in a responsible manner.

- Providers establish digital customer connections by creating channels for secure data exchange and encouraging greater data sharing to amass information about customer characteristics, contexts, behaviors and sentiments.

- Providers pursue interactive co-creation of solutions by involving customers—or incorporating the customer voice—in product development and product management activities and processes.

Our research found that companies that are better at working these levers are more likely to produce data analytics features and experiences that advise, adapt, anticipate, and act, which results in greater financial returns.[foot]2018 MIT CISR Creating Competitive Products with Analytics Survey, N=511. For launched wraps (N=242), we split top/bottom performers on surrogate measures of Credibility and Trust (N=32/69), Digital Connections (N=78/69), and Innovation and Co-Creation (N=48/35). Wraps had higher levels of anticipate, advise, adapt, and act design characteristics amongst high performers. Also, logistic regression analyses identified all three concepts as significantly driving top performers. All results were significant at p<.05.[/foot] Our case studies suggest that this happens because credibility and trust, digital customer connections, and interactive solution co-creation collectively increase a provider’s decision-making power and the agency to perform action on behalf of a customer, and improve a provider’s knowledge of core and latent customer needs.

To explore the joint sphere concept in practice, MIT CISR conducted a case study of PepsiCo and its suite of analytics capabilities, PEPWORXSM.[foot]B. H. Wixom, “PepsiCo Unlocks Granular Growth Using a Data-Driven Understanding of Shoppers,” MIT Sloan CISR Working Paper No. 439, December 2019, https://cisr-mit-edu.ezproxy.canberra.edu.au/publication/MIT_CISRwp439_PepsiCoDX_Wixom.[/foot] Since 2014, PepsiCo invested in data and advanced analytics capabilities—and used them to better serve its retail customers. In 2018, PepsiCo received industry recognition for building partnerships with its customers, earning #1 Supplier in Multichannel in USA in the Advantage Awards,[foot]The Advantage Awards program from Advantage Group International recognizes high-ranking suppliers and retailers according to annual the group’s Advantage Report results. “Advantage Awards,” Advantage Group International, https://www.advantagegroup.com/why-advantage-group/advantage-awards-2018.[/foot] and the top position among suppliers (for the third consecutive year) in the PoweRanking® report.[foot]Kantar Consulting’s US PoweRanking® report is the retail industry’s leading assessment of best-in-class manufacturers and retailers. “POWERANKING 2018: Shifting Gears,” Kantar Consulting, https://consulting.kantar.com/news-events/pepsico-claims-top-spot-three-years-running-in-2018-poweranking-for-suppliers/.[/foot]

Figure 1: The Provider-Customer Joint Sphere

PepsiCo Builds Collaborative Partnerships

In 2019, PepsiCo was a $65 billion global consumer packaged goods company headquartered in Purchase, NY with 267,000 employees worldwide. In late 2014, PepsiCo’s Executive Committee invested in establishing a new enterprise-level shopper insights unit called the PepsiCo Demand Accelerator (the DX). The DX launched in early 2015 with approximately 180 people drawn from units across PepsiCo such as Category Management and Shopper Insights. The new unit reported to the Chief Commercial Officer for North America and was charged with creating and delivering standardized enterprise-wide data-driven marketing services.

Over the subsequent four years, the DX helped establish an advanced analytics platform, a large anonymized shopper-level data set, and an array of information solutions to support the sales and marketing needs of PepsiCo—and of PepsiCo’s retail customers. By 2019, the DX formally packaged its shopper insights into a suite of data analytics capabilities called PEPWORXSM, which helped its users better understand how to optimize store-level assortment and total store space, manage marketing dollars more effectively, and successfully launch and manage innovative marketing programs.

Developing Credibility and Trust

DX associates used proofs of concept and testing to validate the effectiveness of their solutions. They also invested in experimentation; for example, A/B testing helped DX associates control for all other factors to identify the true impacts of a change being proposed or executed. Additionally, DX associates prioritized retailer goals such as profitability when formulating solutions, even when that goal meant advising against more space for PepsiCo products.

Establishing Digital Customer Connections

Many retailers granted the DX access to some of their retail data so that the DX could tailor solutions to the retailer’s specific needs.[foot]When retailers provided data for projects specific to their needs, the DX did not share that data beyond the project team.[/foot] PepsiCo’s cloud-based data platform offered secure access for data exchange as needed. In one case, DX associates combined PepsiCo’s data about the number of gallons of syrup the retailer used with the retailer’s data about its syrup purchases from other providers so that the DX team could help the retailer maximize fountain drink sales by store. The DX team developed an ensemble of machine learning models that identified specific store and shopper attributes that influenced syrup usage.

Pursuing Interactive Co-Creation of Solutions

Often, large retail partners had complex problems that required custom solutions. DX associates identified important retailer problems to solve during a formal annual process called Joint Business Planning (JBP). During JBP activities the retailer and the DX and other PepsiCo units identified ways to mutually drive growth aspirations. Over time, JBP increasingly became more interactive and iterative, which led to better collective thinking and stronger programming.

Creating Real Value with Customers: A Checklist

In the digital economy, providers that position themselves to be trusted by, connected to, and interactive with their customers will more predictably generate financial returns from their data monetization efforts. Companies that are building partnerships with their customers will answer yes to the following questions:

- Do you understand to what extent your products make or save your customers money—and do you monitor when it happens?

- Do your success metrics include customer performance?

- Do you have professional services roles or units that support customer needs beyond current offerings, and do they have a seat at the table when customers strategize?

- Does your customer data extend beyond transactional data sources to inform latent customer needs?

- Do you have a secure way to exchange data with customers?

- Do you have data governance processes that oversee ethical use of customer data?

- Have you been given explicit permission to establish automated actions that do something on behalf of customers?

Don’t leave value to chance; build partnerships with customers. Doing this will ensure that customers use data analytics-based features or experiences, which will help the potential value from data analytics features and experiences materialize.

© 2019 MIT Sloan Center for Information Systems Research, Wixom and Sebastian. MIT CISR Research Briefings are published monthly to update the center's patrons and sponsors on current research projects.

About the Authors

MIT CENTER FOR INFORMATION SYSTEMS RESEARCH (CISR)

Founded in 1974 and grounded in MIT's tradition of combining academic knowledge and practical purpose, MIT CISR helps executives meet the challenge of leading increasingly digital and data-driven organizations. We work directly with digital leaders, executives, and boards to develop our insights. Our consortium forms a global community that comprises more than seventy-five organizations.

MIT CISR Associate Members

MIT CISR wishes to thank all of our associate members for their support and contributions.